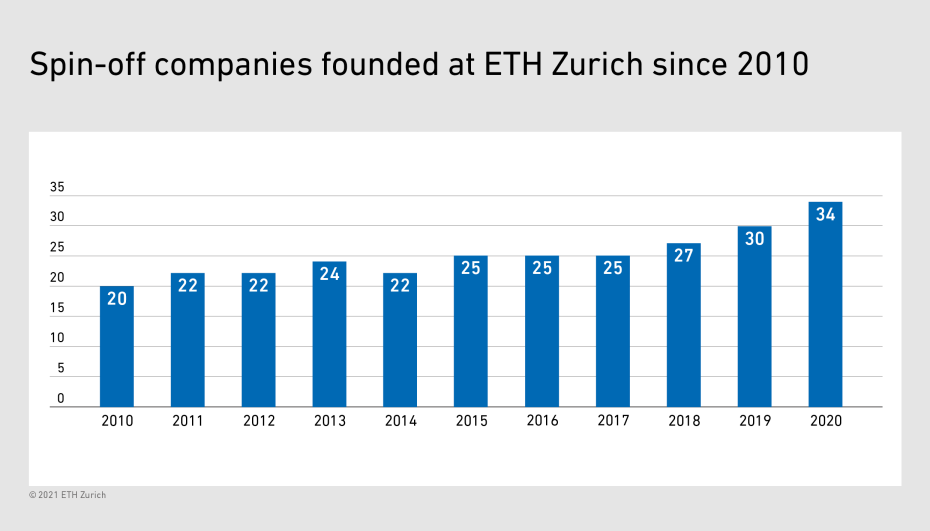

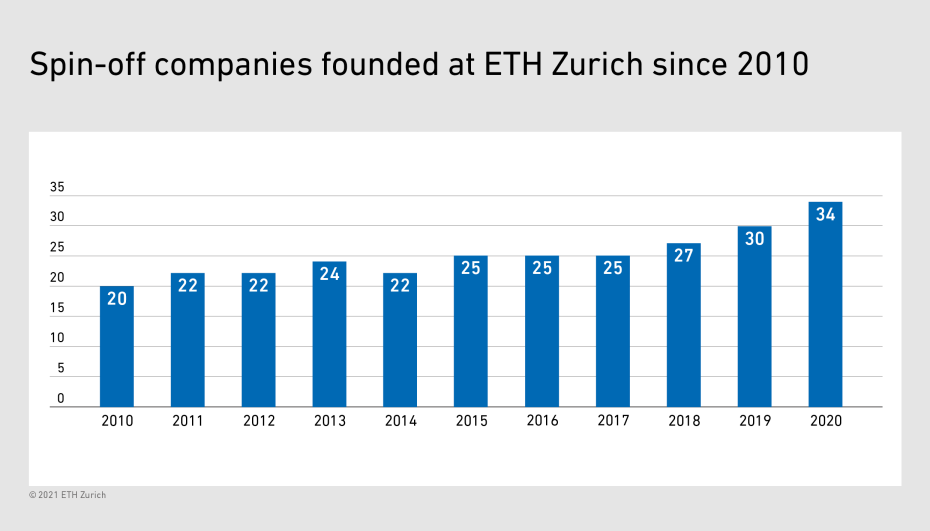

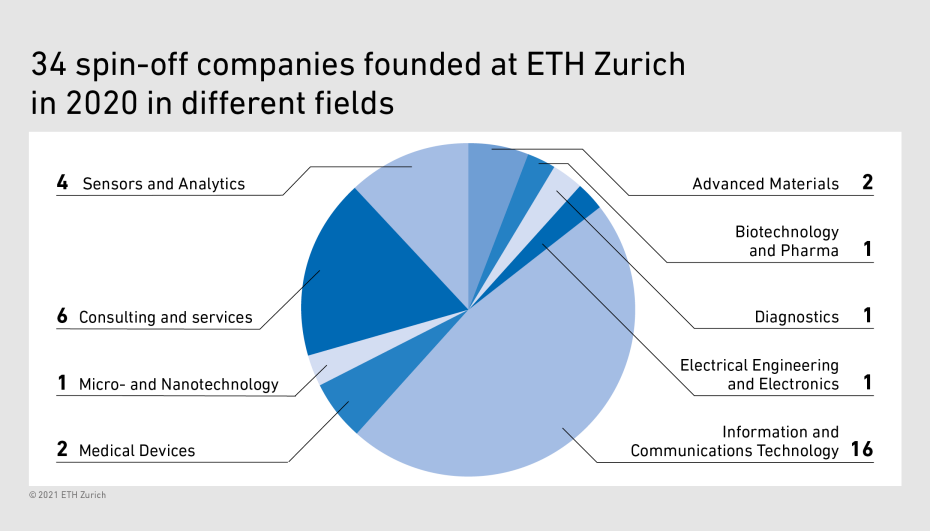

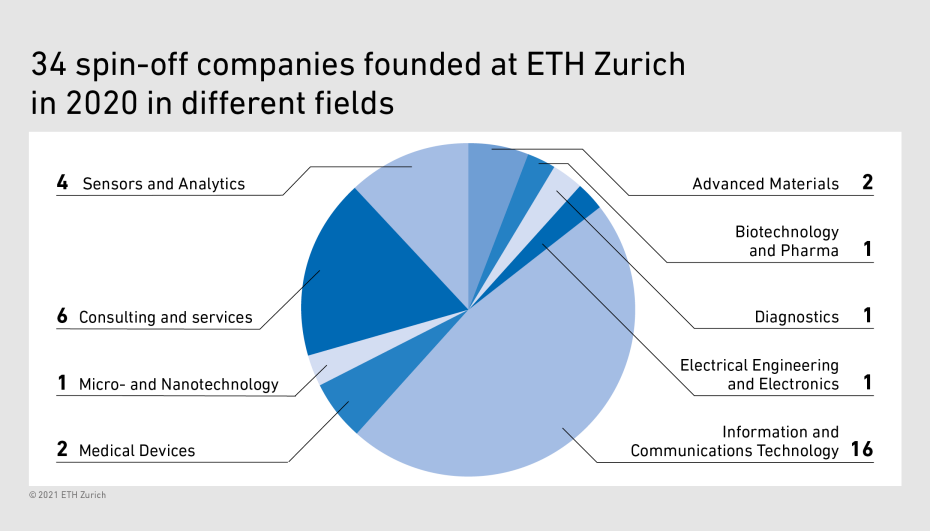

In 2020, 34 spin-offs were founded at ETH Zurich, with a striking proportion in the areas of AI and sustainability. Financing rounds totalling more than CHF 400 million and HeiQ’s public listing bear witness to the market success of existing ETH spin-offs.

ETH Zurich can look back on a very successful year for spin-offs: 34 founding teams took the leap to independence. The number of spin-offs founded per year has increased steadily in recent years, culminating in a new record this year. As in previous years, many new spin-offs have been founded in the field of information and communication technology, with 11 based on artificial intelligence (AI).

Artificial intelligence on the rise

The spin-off Assaia, for example, develops software that enables the optimisation of aircraft handling at the gate and thus saves valuable time. Computer vision and AI are used to monitor, analyse, and improve all the relevant steps, such as refuelling and loading, and the interactions between the various parties involved. AI Retailer Systems, meanwhile, uses computer vision and artificial intelligence to register which products a customer takes from a shop and bill them without passing by a cash-register. A further example is Sleepiz, which is developing a device aimed at identifying the causes of sleep disorders. In future, the device will be placed on bedside tables and record patients’ movements by means of radar technology; artificial intelligence will help to identify their sleep patterns.

In addition to AI, sustainability also plays an important role for the new ETH spin-offs, six companies are developing products or services in this area. Yasai, for example, focuses on sustainable vertical farming of vegetables in Switzerland. Compared with conventional cultivation methods, this approach needs less floor space, just a fraction of the water and no pesticides, as the air can be filtered. Founder Mark Zahran had the idea during his studies at ETH Zurich.

Younger founders and more women

Zahran is not alone – increasing numbers of ETH students are founding a spin-off straight after their Master’s studies, demonstrating their business instinct for the market. Detlef Günther, Vice President for Research, attributes this development to the strong start-up ecosystem and internal support at ETH. Günther, who was also responsible for corporate relations at ETH until 1 January 2021, has just handed this area over to the new Vice President for Knowledge Transfer and Corporate Relations, Vanessa Wood. “I’m pleased that founding a new company is well-established at ETH, and I’m deeply impressed by the naturalness in which more and more talented young researchers are bringing their ideas to the market. I’d like to wish my new colleague Vanessa every success in developing this fascinating area further,” says Günther. Wood, whose research group members founded the ETH spin-off Battrion in 2015, looks forward to supporting future ETH spin-offs in return: “I know from experience how much courage and determination it takes to establish a company.” Although still significantly more men than women take this step, Wood adds, the number of female founders at ETH has risen slightly in recent years (six spin-offs were co-founded by women in 2020). “I hope to be able to empower more women in future to bring their ideas to the business world,” she says.

Hugely successful on the market

According to a study published by the University of St.Gallen on behalf of ETH Zurich in August, ETH spin-offs not only generate significantly more jobs than the average Swiss start-up, they are also more likely candidates for acquisition. ETH spin-offs performed well in the market also in 2020, raising more than CHF 400 million in capital. GetYourGuide, Climeworks and Scandit, for example, closed financing rounds of CHF 129 million, CHF 100 million and CHF 77 million respectively. Snyk, a leading company in code security analysis, acquired the young AI spin-off DeepCode. Innovative textile and specialty material leader HeiQ, founded in 2005, began trading on the London Stock Exchange in 2020. It is the first listing of an ETH spin-off on a stock exchange outside of Switzerland.